Income

The reason that I began this exercise was to try to replace lost income at a time when I wasn't working. Although the unemployment didn't last long, it's still my goal to be able to match my net income from a job. Amazingly, I was able to do this on average. In fact, there was one month that I even matched my gross income. Since I will eventually need to pay taxes on these earnings, if I was able to be able to duplicate this feat on a monthly basis, I would no longer feel the need to work. Alas, that's not yet the case.

Yield

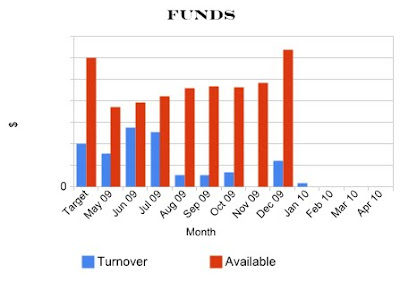

I've also been able to meet my my goals in terms of yield. I measure yield in two ways. First, I measure the percentage yield in terms of the amount turned over as part of the realized gain. If I bought $10,000 worth of stock and sold it at $11,000 for a gain of $1,000, my turnover yield would be 10%. If I had $100,000 funds for investing at the end of the period, then the available yield (or portfolio yield) associated with that transaction would be 1%. I've surpassed my 5% goal for turnover yield with an actual yield of 8.49%. 2.49% also surpasses my available yield goal of 2%. This second goal has been compromised a bit by my movement of additional funds into the available pool by transferring IRAs in from other accounts.

As noted above, I've brought in additional funds that have actually put me over my target for this investing pool. This would be great if I was always fully invested along with meeting my yield goals. But it's proven difficult to stay invested (and maintain high levels of realized gain). So I'm currently struggling with my options for these excess funds. I could keep them in the pool for possible investing, or I can invest in CDs, or I can look at putting some of these funds in a longer term stock position. This is proving to be a difficult decision due to the low yields in CD and dividends in the current environment. But I have some other CDs maturing in the next 6-8 months, so I need to develop an appropriate strategy for this.

Percent Invested

As I've said, staying invested is a challenge. My hope is that I would stay 50% invested with constant buying and selling. But the reality is that there are periods of acquisition and periods of disposition that follow general market trends. So the percent invested swings significantly. The chart below is not really representative since it only shows the values at the end of the month. There are typically intra-month peaks and valleys too.

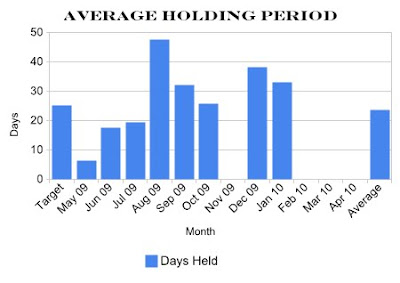

Holding Period

Obviously a short holding period is a good thing assuming that yield goals can be met. But given the low percentage invested, I've trended toward longer holding periods in recent months in order to eek out a few more basis points of yield. I've really struggled with this concept. On one hand, I had good luck during my first few months by taking a quick 5% yield, dumping the stock and then reinvesting in the same stock when it dropped back to my initial buy-in price. But I saw a lot of cases where the stock continued to rise after I sold and I didn't like leaving that money on the table. At the same time, I've seen stocks rise to 7-8% yields and I've held out for 10% only to see it drop the the initial levels. I guess this only goes to prove the old adage that "you can't time the market."

Summary

Although I haven't been able to hit all my goals, this experiment has proven successful beyond my expectations and is certainly worth of ongoing attention and refinement. Although you can't time the market, I will continue to try with most of my current efforts focused on how to determine the best buy-in time. This should boast my percentage invested. Then I'm sure the pendulum will swing and I'll be focused on when I should get out of a position. If nothing else, this has proven to be an interesting, challenging and most importantly, profitable venture.

No comments:

Post a Comment