While the end of the year is not yet here, it's close enough to look back at the last two years and analyze my trading.

2009 vs 2010

I've clearly refined my trading strategy over the last year and it has created some observable results.

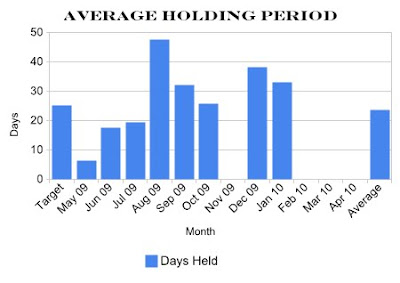

in 2009 I felt that I was leaving too much money on the table, so I changed my strategy to seek higher return on each individual trade. I've succeeded in this goal as per investment return is improved and I'm receiving quite a few more dividend payments than in the past. However, this has come at the cost of greatly increased holding periods and lower overall realized gain.

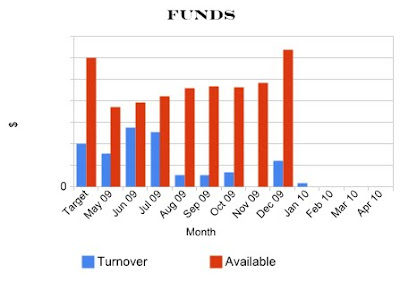

I also greatly expanded my pool of trading capital with my available capital tripling since I started this exercise. These funds have come from a combination of realized gains and infusions of cash from other rollover accounts. This extra capital has gone largely uninvested as percent invested in the last quarter and is well below 2009 levels. I have mixed emotions about this. Obviously I hate to have money sit idle while money markets are paying no interest, but I do like the idea of having ready cash available to capitalize on a bear market.

In 2010 I adopted a strategy where I would spend up to 25% of the available pool buy stocks at a premium price. This strategy was explained in an earlier post and makes a lot of sense for all market conditions. But it is especially practical in a bull market. However, I must admit that I have not followed through on this strategy and have continued to bottom feed. I'm sure this has cost me some gains.

Another thing that changed since I've been trading is my job status. I started this exercise during a two month gap in employment and those two months were among my most productive. I've worked throughout 2010 and there have definitely been some missed buying and selling opportunities because I wasn't monitoring things as closely as I could when I wasn't working. It's very doubtful that I would be able to completely offset my working income by trading, but I'm convinced that there is a difference.

Performance vs the market

There are not big surprises in the comments above because I've been watching these developments closely as I've been trading. But my results against the market are a little more surprising.

I've always steered away from the market index approach to investing, but there are clearly a lot of adherents to this philosophy. When I compare my results for the last two years to the overall market, I'm not as far ahead as I thought.

With these results, I must acknowledge that the overall performance of the market over the period I've been investing is better than mine!

With these results, I must acknowledge that the overall performance of the market over the period I've been investing is better than mine!

But I must also add some caveats to that last statement. I would argue that my holdings have held less risk because I was rarely 100% invested and earning market returns would require 100% over the whole periods. Although a index advocate would surely argue that their approach is less risky because it was more diversified.

I also must point out that these are measuring apples and oranges to a degree. Market returns assume 100% reinvestment and all returns are essentially unrealized. Whereas my strategy is specifically directed toward realizing gains as quickly as practical.

These market results above are looking at the market themselves, not representative funds. So they exclude fund administrative expenses. I hate the fact that these black and white numbers don't convince me, but I remain sceptical of fund companies.

Since underinvested funds has been such a concern, I looked closely at my performance again my opportunity cost. I know I can invest these same funds in 5 year CDs and not have to worry about managing the trades. But my return far exceeds those opportunity costs.

Action Plan

Obviously I can't ignore these findings, so there are several things that I plan to do to help maximize gain.

1. Partially revert to 2009 strategy and take profits a bit sooner. In 2009 I was pretty fixed on a 5% gain. While I don't think I'll be that aggressive about profit taking, I will lower my standards.

2. Reduce or cap investment pool. I think I've reached my limit with regards to funds I'm willing to manage. My strategy doesn't lend itself to making a lot of buys and I'm not willing to sink a larger percentage into a given stock. So I no longer need to grow the pool and perhaps need to shrink it. But I'm not sure where I want to put them. I could move funds to CDs, but it's hard to go back to such low returns. I could also adopt a buy and hold strategy toward income stocks. But this would really be a variation on what I'm currently doing. More to come on this.

3. Quit bottom feeding! I should be more open minded at buying stocks at somewhat premium prices within my designated limits. I've seem too many stocks slip away before they hit my standard buy price.

4. Dabble in Index Funds. I can't believe I'm saying this, but the results of the last two years can't be ignored. I need to do further research on this. I'll certainly take a look at some specific funds and perhaps even invest a small amount of money into a fund over a period of time.

5. Don't sweat employment. My current project ends in two weeks and I don't currently have another gig lined up. Perhaps some more time off is in my future? If so, I'll be a full time trader again and see if I'm able to improve my returns as a result.